We seek to make investments that have a positive impact on the world and work with our investment managers to appropriately consider environmental, social, and governance issues. We also advocate for corporate social responsibility with portfolio companies, and collaborate with others to advance best practices in SRI and catalyze socially responsible investments.

Our socially responsible investing strategy includes the following four pillars:

Positive Impact Investing

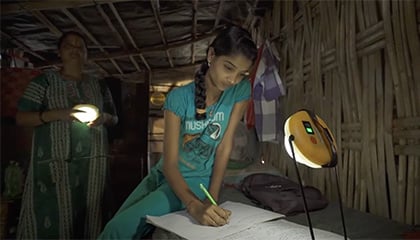

The Church Pension Fund (CPF) aims to achieve competitive financial returns while making a positive social impact. This includes investments in affordable housing, renewable energy, sustainable agriculture, and underserved communities.

Shareholder Engagement

CPF leverages its position as a significant institutional shareholder to address corporate social responsibility issues that have long-term investment implications. By promoting dialogue and filing shareholder resolutions, CPF encourages companies to align their practices with the concerns of The Episcopal Church.

CPF's engagement focuses on environmental sustainability, human rights, and increasing diversity among corporate leaders. We collaborate with the Committee on Corporate Social Responsibility (CCSR), The Domestic and Foreign Missionary Society (DFMS), and other investor groups to discuss ways to address our shared concerns.

ESG Incorporation

Our Investments team recognizes that environmental, social, and governance (ESG) issues can present significant opportunities and risks. CPF engages third-party managers to decide which investments to make with its assets. As part of the analysis and review process, CPF collaborates with both current and prospective managers to assess how they incorporate ESG considerations into their investment decisions.

Thought Leadership

Our thought leadership initiative brings together experts in socially responsible investing (SRI) to share best practices and drive increased investment in the space. Our Investments team participates in various industry working groups to promote diversity, environmental responsibility, and faith-based investing principles.

The Insights & Ideas conversation series is our key platform for bringing together thought leaders from the Church and the private sector.

These discussions aim to share ideas, experiences, and insights to advance socially responsible investing. We also regularly attend and speak at conferences around the world, with the aim of elevating the industry’s shared understanding and approach to SRI.

You will be redirected to a new tab for live remote support. Please confirm you're on a call with a Client Services team member to continue.