Saving for Retirement

When Should I Start?

The Power of Saving Early

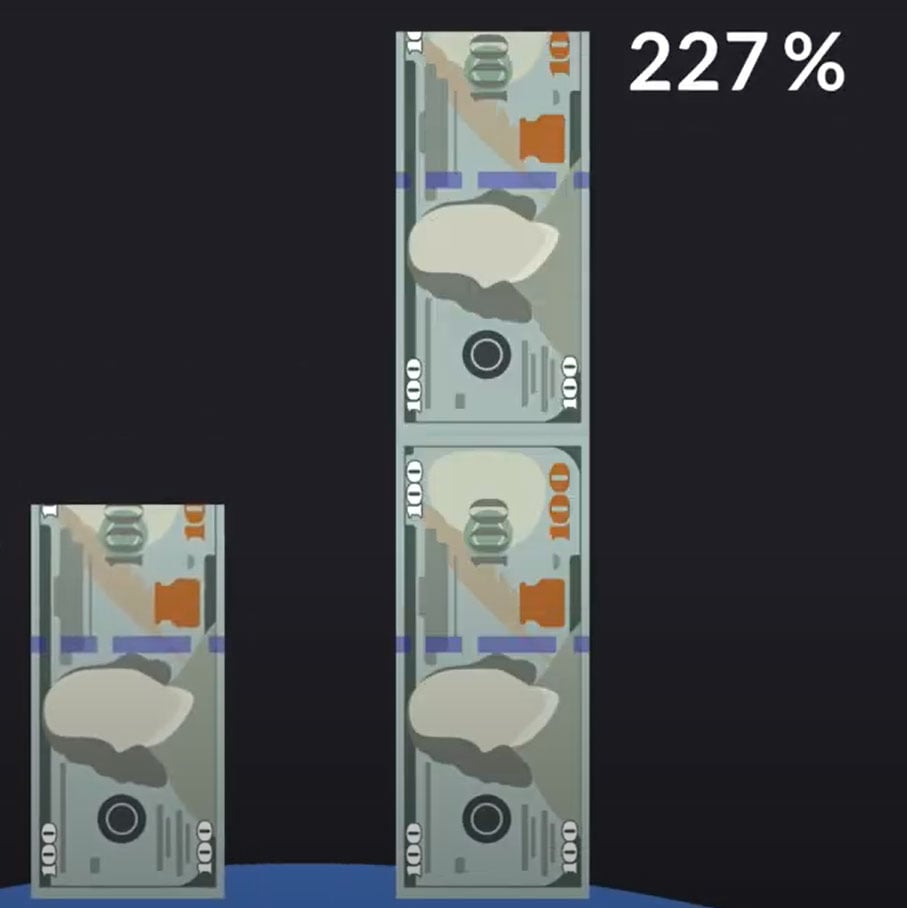

Every dollar you put away can help increase your retirement security and compound just the same. But money saved actively at a younger age could be worth more than money saved later in life because it will have a chance to compound for much longer.

What Difference Can a Regular Contribution Make?

If you saved just $100 per month for 20 years, you will have deposited $24,000, or $1,200 per year. If you achieve a 6% return on your investment, your account could grow to $46,000.

Using the Rule of 72, you can find out how long it takes to double your investment.

How Can I Save More?

Having Trouble Finding Money to Save for Retirement?

Saving for retirement isn’t always easy. Saving for Retirement offers tips, tactics, tools – and lots of encouragement as you take steps to increase your savings for retirement. We’ll show you how easy it can be to invest your savings and increase your retirement security.

These Strategies Can Help.

Sometimes, money you can save for retirement is right there in front of you — it’s just hard to see. Here are three great ways to contribute more to your Episcopal Church retirement savings plan.

The Power of Compound Interest

Ever Hear of Compound Interest?

It's the financial term for how interest accumulates. Whether you know it for not, at some point you've benefited from it. Albert Einstein, himself, even called Compounding the 8th Wonder of the World.

Here's How It Works

You save money and start to earn interest. Then, you're not only earning interest on your initial savings, but on that interest as well. Every year thereafter, you're earning interest on a greater amount of money, and consequentially, earning a greater amount of interest.

Here's a Simple Example

If you invest $5,000 and earn 6% interest*, after a year you'll have $5,300. That second year, you're no longer earning interest on $5,000, but $5,300. See how much you could have after ten years. Here's a hint. It's a lot!

*The data/charts shown are for illustration purposes only.

To Learn More

For information about these strategies or to get answers to your questions about saving call us at (888) 735-7114, Monday – Friday, 8:30AM – 8:00PM ET (excluding holidays).

You can also access your account now by visiting www.cpg.org/myaccount.

You will be redirected to a new tab for live remote support. Please confirm you're on a call with a Client Services team member to continue.